|

| 10 Top No-Credit-Loan and Funding Options for Startups in 2025 |

This post first appeared on Ayi Post.

Starting a business without an established credit history doesn't have to be a roadblock.

Whether you have bad credit, no revenue history, or are a first-time entrepreneur, many funding options exist that focus on your business potential, revenue projections, or alternative qualifications rather than traditional credit scores.

This comprehensive guide covers startup business loans for bad credit, funding options that require no personal guarantee, and alternative financing solutions specifically designed for new businesses with limited credit history.

Who Qualifies for No-Credit-Check Business Funding?

1. New startups with no business credit history or revenue

2. Entrepreneurs with bad credit (FICO scores below 600)

3. First-time business owners without collateral or personal guarantees

4. Businesses with strong revenue potential but limited credit history

5. Minority and women-owned businesses seeking alternative financing

6. Companies with valuable assets or outstanding customer invoices

Qualification typically depends on factors like business viability, revenue streams, collateral, or personal guarantees rather than credit scores.

Many lenders focus on your ability to repay based on cash flow projections rather than past credit performance.

Let’s find out what No-Credit-Check business loans are?

No-credit-check business loans provide funding without requiring a hard pull on your personal or business credit reports. Instead, lenders evaluate your application based on alternative criteria such as:

a. Bank statements and cash flow analysis

b. Business plans and revenue projections

c . Asset values and collateral assessment

d. Industry experience and business potential

e. Outstanding invoices or accounts receivable

These financing options are particularly valuable for startups with no revenue, entrepreneurs with credit scores under 600, or businesses that need funding without personal guarantees.

What are alternative funding approaches for bad credit businesses?

If traditional no-credit-check loans aren't suitable, consider these alternatives specifically designed for entrepreneurs with limited credit:

a. Small business grants and local government funding programs

b. Crowdfunding campaigns for product-based startups

c. Venture capital for high-growth potential businesses

d. Community development microfinance programs

e. Secured business credit cards for building credit history

f. Equipment financing with the equipment as collateral.

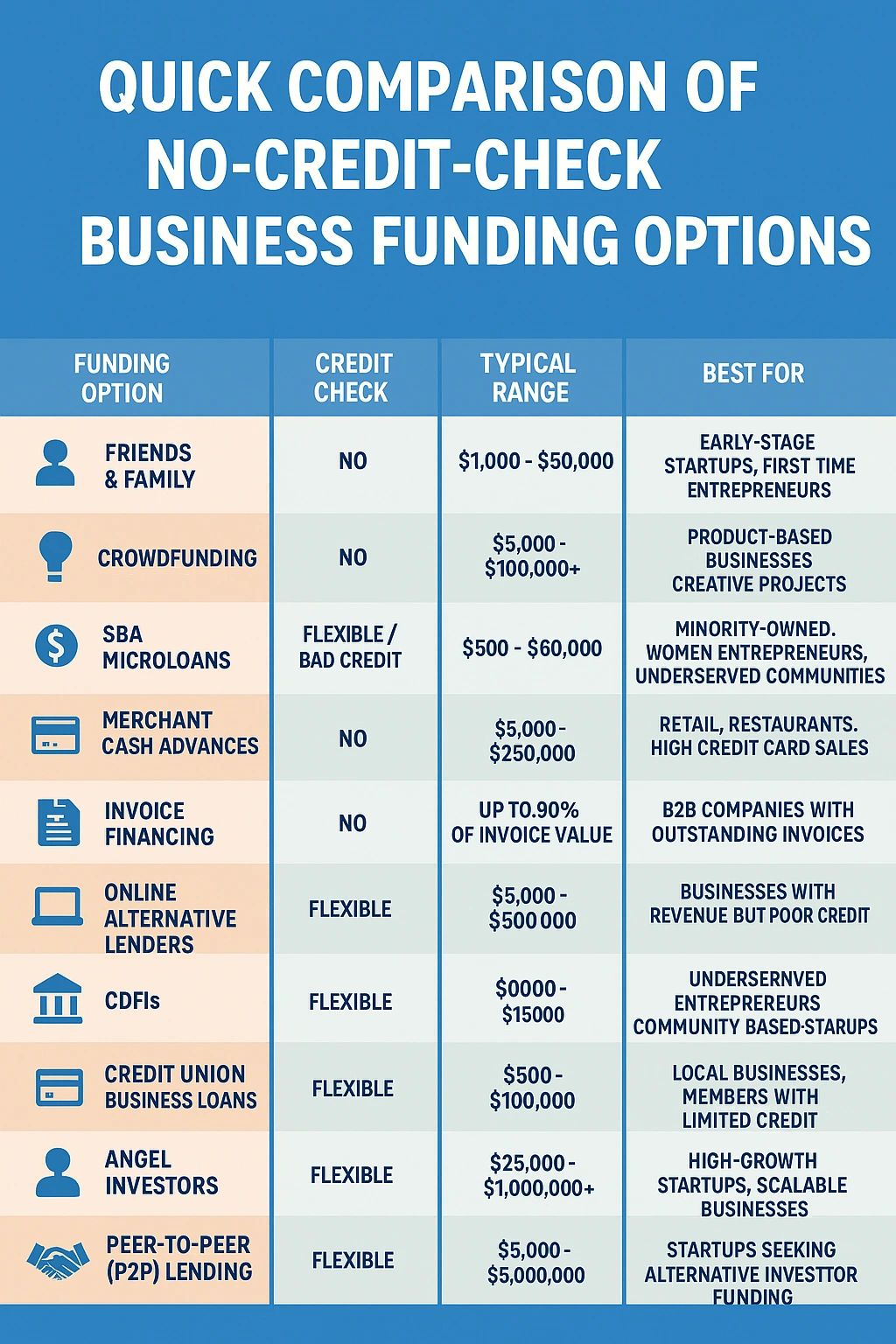

Here are 10 Funding Options Ranked by Accessibility

Ranked from most accessible to most competitive based on approval requirements and application complexity

1. Friends and Family Funding (No Credit Check Required)

Personal networks often provide the most accessible startup capital for entrepreneurs with bad credit, with informal lending arrangements between business owners and their trusted contacts.

Best for: First-time entrepreneurs, family businesses, very early-stage startups with no revenue

Pros:

- No credit checks or formal collateral requirements

- Flexible, negotiable repayment terms

- Quick access to funds with minimal paperwork

- Potential for interest-free or low-interest loans

Cons:

- Limited funding amounts based on personal network wealth

- Risk of damaging personal relationships if business fails

- Often lacks formal legal protections or documentation

- May create awkward family dynamics around money

Typical Range: $1,000 - $50,000

2. Crowdfunding Platforms (Zero Credit Requirements)

Online platforms like Kickstarter, Indiegogo, and GoFundMe allow entrepreneurs with no credit history to raise capital from large numbers of small contributors.

Best for: Product-based businesses, creative projects, consumer-facing startups with compelling stories

Pros:

- No credit requirements or personal guarantees needed

- Doubles as marketing and customer validation tool

- Keeps full business ownership (reward-based crowdfunding)

- Can build community around your brand

Cons:

- Requires intensive marketing and promotion efforts

- No guarantee of reaching funding goals

- Platform fees reduce total funds raised (typically 3-5%)

- Public failure can damage brand reputation

Typical Range: $5,000 - $100,000+

3. SBA Microloan Programs (Bad Credit Friendly)

The Small Business Administration's Microloan Program provides small loans through approved intermediary lenders, focusing on underserved entrepreneurs and minorities with limited credit access.

Best for: Minority-owned businesses, women entrepreneurs, startups in underserved communities, businesses under $50K funding need

Pros:

- Lower interest rates than alternative lenders (6-13% typically)

- Designed for first-time entrepreneurs and minorities

- Often includes business mentorship and training programs

- More flexible credit requirements than traditional banks

Cons:

- Limited loan amounts ($500 - $50,000 maximum)

- May still require personal guarantees for larger amounts

- Longer application process than online lenders

- Geographic limitations based on intermediary locations

Typical Range: $500 - $50,000

4. Merchant Cash Advances (No Personal Guarantee Required)

MCA providers like Rapid Finance advance funds based on future credit card sales, with repayment automatically deducted from daily transactions. No credit check or personal credit score requirements.

Best for: Retail businesses, restaurants, service companies with high credit card transaction volumes

Pros:

- Approval based on sales volume, not credit history

- Very fast funding (often within 24-48 hours)

- Automatic repayment reduces default risk for lender

- No fixed monthly payments (varies with sales)

Cons:

- Extremely high effective interest rates (often 20-50% APR equivalent)

- Daily payment deductions can strain cash flow

- Can create debt cycles if business struggles

- Best suited only for high-volume credit card businesses

Typical Range: $5,000 - $250,000

5. Invoice Financing Companies (Asset-Based, No Credit History Required)

Companies like FundThrough and BlueVine advance funds against your outstanding customer invoices, using those invoices as collateral instead of requiring good credit.

Best for: B2B service companies, freelancers, businesses with net-30/60 payment terms, companies with reliable customers

Pros:

- Uses existing invoices as collateral instead of credit

- Fast funding (often same-day) once approved

- Particularly effective for B2B businesses with net-30/60 terms

- Doesn't require additional collateral or personal guarantees

Cons:

- Only viable for businesses with outstanding invoices

- Fees reduce profit margins (typically 1-5% of invoice value)

- Customer payment delays directly impact your cash flow

- Some arrangements require customer notification

Typical Range: Up to 90% of invoice value

6. Online Alternative Lenders (Bad Credit Specialists)

Fintech companies like OnDeck, Kabbage, and Funding Circle use alternative data and faster underwriting to serve businesses that don't qualify for bank loans, including those with credit scores under 600.

Best for: Established businesses with revenue but poor credit, e-commerce companies, businesses needing fast funding

Pros:

- Rapid approval process (24-72 hours typically)

- Minimal paperwork and streamlined applications

- More flexible qualification criteria than traditional banks

- Some lenders focus specifically on startups and small businesses

Cons:

- Higher interest rates than traditional bank loans (10-30%+)

- Shorter repayment terms increase payment pressure

- Some lenders have hidden fees or prepayment penalties

- Less personal service than community lenders

Typical Range: $5,000 - $500,000

7. Community Development Financial Institutions (CDFIs)

CDFIs like Accion Opportunity Fund are mission-driven lenders that serve underserved communities and entrepreneurs who can't access traditional bank financing.

Pros:

- Lower interest rates than online alternative lenders

- Specifically designed to help underserved entrepreneurs

- Often provide business counseling and mentorship programs

- More patient capital with community development focus

Cons:

- Slower application and approval process than online lenders

- Generally smaller loan amounts than traditional banks

- May have geographic or demographic restrictions

- Limited locations and availability

Typical Range: $500 - $100,000

8. Credit Union Business Loans

Many credit unions offer small business banking services, including loans with more personalized underwriting than large banks.

Pros:

- Lower interest rates and fees than online lenders

- More personalized service and flexible underwriting

- May consider factors beyond credit score for small loans

- Non-profit structure often means better terms

Cons:

- Membership requirements must be met first

- Slower approval process than online alternatives

- Limited to credit union members in specific geographic areas

- Smaller loan amounts than major banks

Typical Range: $5,000 - $100,000

9. Angel Investors

Angel investors are wealthy individuals who invest their personal funds in early-stage startups, typically in exchange for equity ownership.

Pros:

- Larger funding potential ($25,000 - $1,000,000+)

- No debt repayment required (equity investment)

- Often provide valuable mentorship and industry connections

- Can lead to additional funding rounds

Cons:

- Requires giving up ownership stake in your business

- Highly competitive process requiring strong pitch and traction

- Investors expect high growth and significant returns

- Loss of some control over business decisions

Typical Range: $25,000 - $1,000,000+

10. Peer-to-Peer (P2P) Lending Platforms

P2P platforms like Funding Circle connect businesses directly with individual investors, bypassing traditional financial institutions.

Pros:

- Direct access to individual investors

- Potentially better rates than merchant cash advances

- More flexible terms than some traditional lenders

- Transparent marketplace pricing

Cons:

- Funding success not guaranteed (depends on investor interest)

- Individual investors often prefer businesses with revenue history

- Platform fees reduce net funding received

- Less personal relationship than traditional lenders

Typical Range: $25,000 - $500,000

Key Considerations Before Applying

1. Compare Total Costs: Look beyond interest rates to include all fees and charges

2. Understand Repayment Terms: Ensure payment schedules align with your cash flow

3. Read the Fine Print: Watch for hidden fees, prepayment penalties, or personal guarantees

4. Consider Growth Impact: Choose funding that supports rather than constrains business growth

5. Plan for Success: Have a clear strategy for how the funding will generate returns

Frequently Asked Questions about No-Credit-Loans

1. Are no-credit-check loans safe for startups?

These loans can be legitimate funding sources, but they often carry higher costs than traditional bank loans.

The key is understanding the total cost of capital and ensuring your business can generate enough return to justify the expense. Always research lenders thoroughly and read all terms carefully.

2. How much can a startup realistically borrow?

Funding amounts vary significantly based on the option chosen:

a. Friends/Family: $1,000 - $50,000

b. Crowdfunding:$5,000 - $100,000+

c. Microloans: $500 - $50,000

d. Alternative Lenders: $5,000 - $500,000

e. Angel Investors: $25,000 - $1,000,000+

Your business revenue, assets, and growth potential will determine the upper limits.

3. Do these funding options help build business credit?

This varies by lender and funding type:

a. Build Credit: Some alternative lenders, credit unions, and SBA microloans report to business credit bureaus

b. Credit Impact: Friends/family loans, crowdfunding, and angel investments typically don't affect credit

c. Check First: Always ask lenders about their credit reporting policies before applying

The best funding option depends on your specific situation, including your funding needs, timeline, business type, and risk tolerance.

Consider consulting with a small business advisor or accountant to determine the most appropriate choice for your startup.

Remember: While these options don't require traditional credit checks, most legitimate lenders will still verify your identity and may review bank statements or business documentation.

Be wary of any lender that requires upfront fees or makes unrealistic promises about guaranteed approval.

Comments

Post a Comment